In recent weeks, we have discussed a number of data points indicating elevated levels of hedging in the equity market. This includes examples from the…

Tagged Inverse ETF Volume

A Curious Spike In Inverse ETF Volume

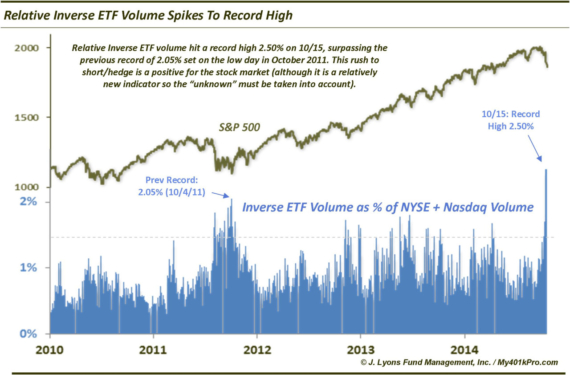

One of our favorite new short-term sentiment gauges in recent years has been relative inverse ETF volume. This indicator measures the amount of volume traded…

Traders Are Shunning Hedges Again

One of our favorite new indicators for gauging investor sentiment the past few years has been the level of volume in inverse equity ETF’s. To…

Record spike in Inverse ETF Volume one sign of a bottom Over the past 2 years, one of our favorite indicators of stock market sentiment…

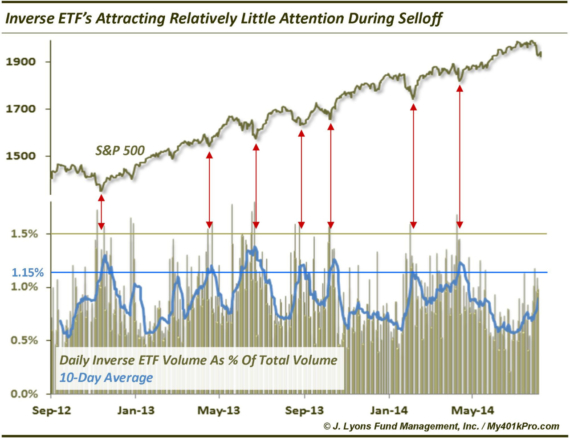

Subdued inverse ETF volume far from fear levels We’ve pointed out evidence of elevated fear (at least in the short-term) coming from the equity options…

ChOTD-4/15/14 Relative Inverse ETF Volume Now At Fear Levels Marking Recent Lows

In last Friday’s ChOTD, we indicated that Relative Inverse ETF Volume (the percentage of volume traded in inverse ETF’s vs. total market volume) had not…

ChOTD-4/11/14 Relative Inverse ETF Volume Not Yet At Fear Levels

A great thing about investment innovation is the supply of new metrics with which to measure market conditions. One of our favorite new indicators, particularly…

ChOTD-2/4/14 Inverse ETF Volume finally picking up, approaching FEAR territory

Originally posted on 2/4/14: stks.co/b0BYG.

ChOTD-1/30/14 Relative Inverse ETF Volume Still too complacent, not @ bottom levels

Originally posted on 1/30/14: stks.co/f0E4j & stks.co/g0EDL.

ChOTD-1/14/14 Complacency: Relative Inverse ETF Volume low again for a -1% day

Originally posted on 1/14/14: stks.co/g09sm.