We’ve written about divergences in breadth (i.e., advancing issues vs. declining issues) on several occasions in the past. These such posts have included breadth divergences…

Tagged $^NYA

Should Investors Really Be Wary Of The Ides Of March?

The “Ides of March” corresponds to March 15th in the Roman calendar. The term became popularized in Shakespeare’s play “Julius Caesar” in which the emperor…

Despite Dow’s Big Up Day, More Volume In Declining Issues

In a February 27 post (Heavy Selling For Such A Small Loss), we noted that despite a minuscule decline in the S&P 500 the prior…

Aging Bull Market Turns 6-Years Old

This post is more of a birthday card for the U.S. equity bull market than anything else. And considering the duration of the bull, if…

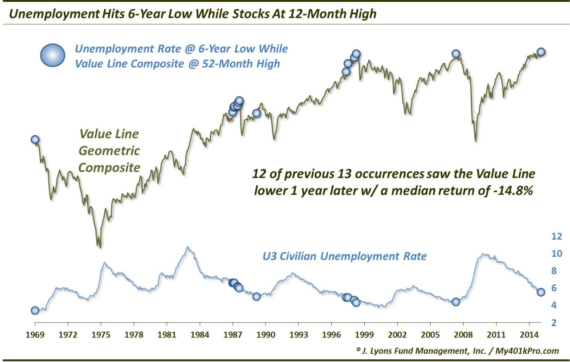

Unemployment Hits 6-Year Low; Bad News For Stocks? OK, before we get a barrage of hate mail, no, we do not think the drop in…

Heavy Selling For Such A Small Loss

On the surface, yesterday was a pretty nondescript day in the U.S. equity market with the major averages showing slight gains or losses. About the…

Broad Stock Index Breaking Above 3-Decade Triple Top?

Back in July we posted a provocative chart of the Value Line Geometric Composite (VLG). The VLG is a broad index of approximately 1800 stocks…

How Ominous Is This Long-Term S&P 500 Sell Signal?

The other day, we wrote a post about one of the continuing longer-term positives in the market: the persistent new highs in the NYSE Advance-Decline…

Are Bears Missing The Forest For The Trees?

With all of the concerns that we and others have mentioned recently regarding the current health of the stock market, sometimes the big picture can…

Broad Market Lagging Behind In Current Rally After a stunning rebound in October, the S&P 500 is back trading at a 52-week high. And you…