Earlier this month, we looked at the circumstances present at the time whereby the S&P 500 and the VIX (S&P 500 Volatility Index) were both…

Tagged $SDS

Does Lack Of Volume Matter At New Highs?

Volume has long been a topic of debate on Wall Street. Some folks argue that elevated volume is needed to “confirm” price moves. Others say…

S&P 500 & VIX Both At Highs: Who Blinks?

We have written quite a bit about the behavior in the volatility indexes of late due to their noteworthy and in some cases, peculiar, behavior.…

Bearish Fund Bets Hit All-Time Low

We have discussed measures of market sentiment on many occasion. These measures take the pulse of the collective mood on the part of a particular…

Bullish Fund Assets Double Bears For 1st Time Since 2001

We’ve talked about various measures of investor sentiment quite often recently. To reiterate, these indicators measure either what investors say they are doing or what…

Tail Risk Indicator Back To Extreme Levels

2014 may well eventually be known for its buildup of various warning signs in the stock market. While the trigger that brings such warnings to…

Stock Option Bulls Go Streaking

One method of analyzing stock market sentiment is by measuring activity in the options market. The benefit of this type of analysis is that, contrary…

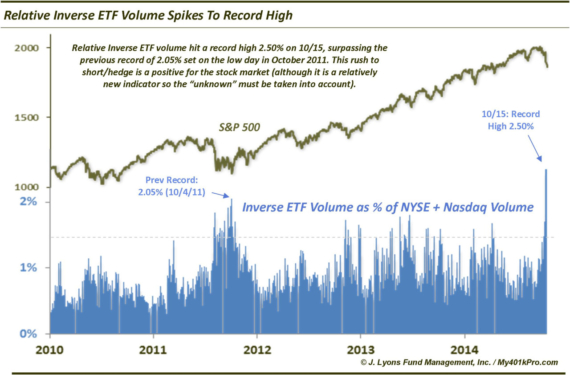

Record spike in Inverse ETF Volume one sign of a bottom Over the past 2 years, one of our favorite indicators of stock market sentiment…

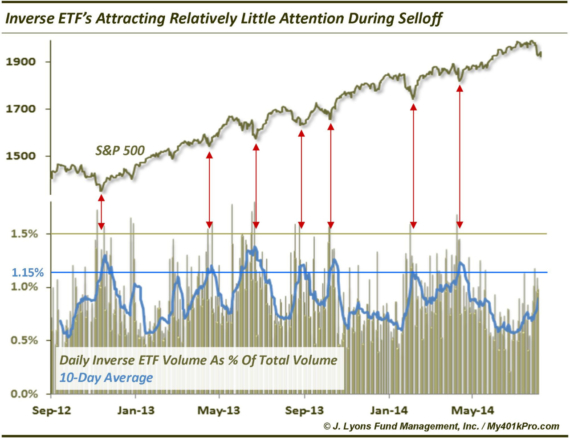

Subdued inverse ETF volume far from fear levels We’ve pointed out evidence of elevated fear (at least in the short-term) coming from the equity options…