Reluctantly, we wade into the economic arena with today’s Chart Of The Day. We have discussed the topic of corporate core capital expenditures (CapEx) on…

From Uncategorized

This shift in a Smart Money indicator may be negative for stocks

The theory goes that trading done in the stock market early in the day is indicative of the eager and emotional “dumb money” reacting to…

A Glimmer of Hope for Oil Bulls

On March 13, we posted a piece on the divergence between the Euro and the Euro Volatility Index (EVZ). The EVZ (like most volatility indexes)…

World’s 2nd Largest Stock Testing Historic Trendline

We don’t often discuss individual stocks, either in our practice or in these pages. So when we dedicate our Chart Of The Day to a…

Signs of Froth in the Biotech Sector

There is a fervent debate in some financial circles regarding the existence – or non-existence – of a biotech bubble. It is a challenging, and…

An Odd Breadth Situation

We’ve written about divergences in breadth (i.e., advancing issues vs. declining issues) on several occasions in the past. These such posts have included breadth divergences…

Can European stocks take the mantle from the U.S.?

Over the past few years, the U.S. has borne much of the weight in terms of global equities. Except for India and just recently, China,…

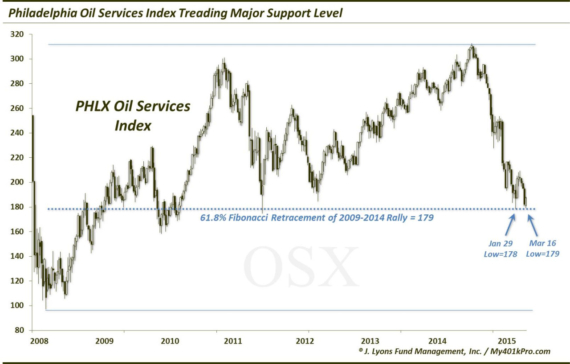

Oil Services Sector Treading Major Support Level After being bludgeoned in the back half of 2014 (to the tune of -35%) along with all oil-related…

“Everything Is Awesome” Brought To You By The Fed

Some days, the stock market soars at the expense of bonds. Other days, it is commodities like oil or gold that shine. And some days,…

“Everything Is Awesome” Brought To You By The Fed

Some days, the stock market soars at the expense of bonds. Other days, it is commodities like oil or gold that shine. And some days,…