Another day, another piece of evidence of this strange, divergence-littered market environment. The subject of today’s Chart Of The Day is once again the small…

Tagged S&P 500

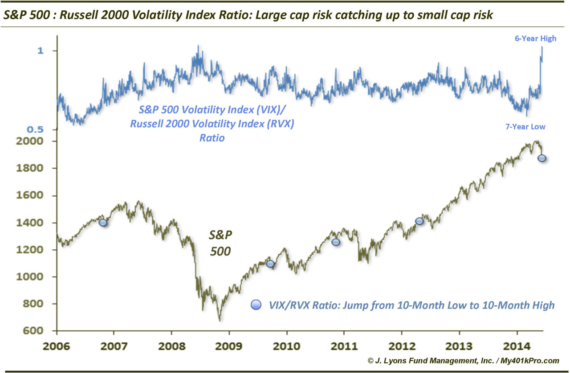

Some Vexing Behavior From The VIX

While the S&P 500 scored another all-time high on Monday, the market once again sent signals that it may not be a smooth ride ahead…

Yesterday Was One of the Ugliest “Up” Days in History

At yesterday’s close the major averages, S&P 500, Dow Jones Industrial Average and Nasdaq Composite, were all in the green. However, despite the fact that…

Is The Rampant Bullish Sentiment Really A Bad Thing?

Given the combination of now wide-open lines of investor communication and a proliferation of new investor engagement metrics, the topic of market sentiment has really…

String of Low Volume New Highs A Short-Term Concern A couple weeks ago, we commented that the waning volume accompanying the rally off the October…

Another S&P 500 New High, Another Odd Divergence

Since the S&P 500 hit a new 52-week high a couple weeks ago, the divergence theme has emerged yet again. We might as well get…

Broad Market Lagging Behind In Current Rally After a stunning rebound in October, the S&P 500 is back trading at a 52-week high. And you…

Sharp rallies on low volume a short (and long?) term concern

We’ve mentioned on numerous occasions that we do not include volume as a significant input into our market analysis. So why 2 posts in three…

Historic shift in volatility from small to large caps There has been an abundance of discussion recently regarding the relative performance of large caps to…

Yesterday’s S&P 500 Reversal Has ZERO Historical Significance

Yesterday’s action in the stock market has generated plenty of speculation regarding a possible bottom following the recent weakness. This stems from the reversal in…