An index of the largest stocks in the market just formed an apparent triple top – but is it a legitimate concern? One topic on…

Tagged $SPX

Margin Debt Drops: Healthy Pullback, Or Budding Headwind?

Pullback in Margin Debt is healthy…unless it signifies the start of a larger decline. In our post yesterday on household stock investment, we discussed what…

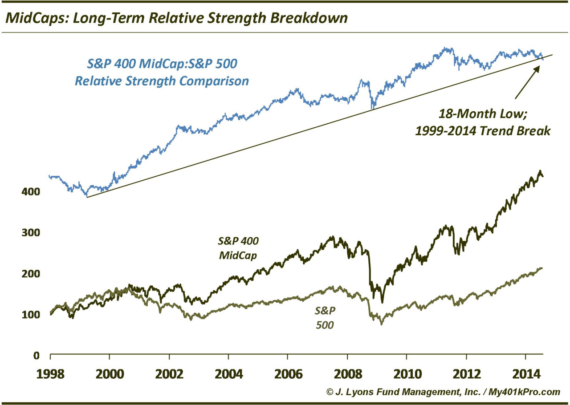

MidCaps: 15-Year Relative Strength Breaking Down Several months ago, we began noting relative breakdowns in key areas of the market. It started first in the…

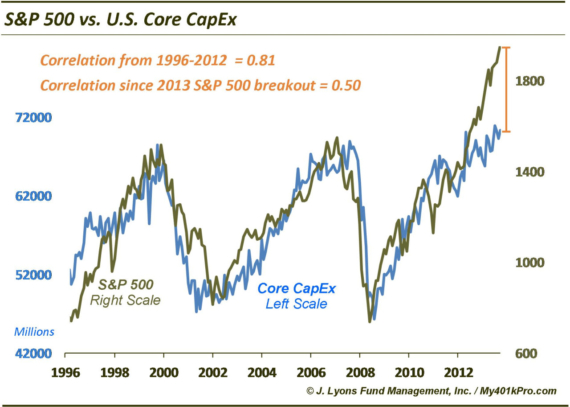

Stocks Leaving CapEx In The Dust The Commerce Department released its monthly look at business spending today and, surprise, Core Capex is still about where…

ChOTD-7/16/14 Smart Money Index (First Hour/Last Hour Indicator): Trend Turning Similar To 2000, 2007?

Today’s ChOTD looks at an interesting indicator called the Smart Money Index (as coined by Jason Goepfert at Sentimentrader.com). The indicator tracks the timing of…

ChOTD-7/11/14 High ISE Equity Call/Put Readings On Down Market Days Have Preceded Drawdowns

Today’s ChOTD looks at the International Securities Exchange (ISE) Equity Call/Put Ratio. For those unfamiliar, ISE presents options ratios a bit differently than most exchanges.…

ChOTD-7/9/14 S&P 500 Days Above 200, 500-Day Moving Averages: Current Streak In Rarified Air

Plenty of folks in the financial blogosphere and media have discussed the S&P 500’s current streak above its 200-day moving average. We thought we’d add…

ChOTD-6/18/14 S&P 500 Average True Range: Volatility Measure Lowest Since February 2007

Touching on the pervasive “low-volatility” theme, today’s ChOTD looks at the Average True Range of the S&P 500 since 2007. Average True Range is a…

Charts Of The Week: Why Recent Index Highs *LOOK* Like Fitting Tops On The Charts

This week we presented a series of charts outlining how recent index highs pass the so-called market top “look test”. By that we mean that…

ChOTD-6/5/14 Why The Recent Highs *LOOK* Like A Fitting Top: S&P 500 Edition

Continuing our series on why recent index highs pass the so-called market top “look test”, today we look at the S&P 500 (previously we looked…