We’ve mentioned before (alright, in nearly every post) that we have several major longer-term concerns with respect to the stock market. One such concern has…

From Uncategorized

Less Than Meets The Eye In Nasdaq Rally?

It’s a day removed from Friday’s all-time high in the Nasdaq but we posted a couple Charts Of The Day today that had folks wondering…

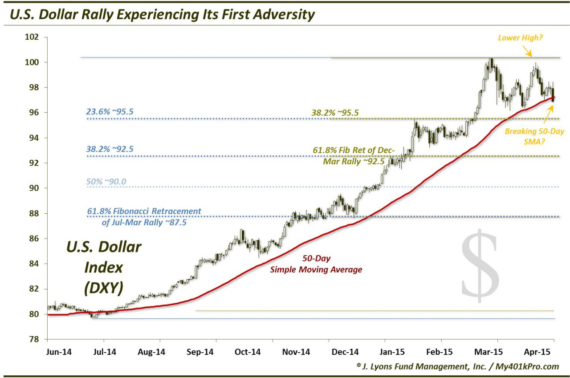

U.S. Dollar Rally Experiencing Its First Adversity Despite all the milestones and records taking place this week in the equity market, at home and abroad,…

Home In The Range: A Rare Streak For The Dow

We’ve dedicated several recent posts to the narrow trading range that has characterized U.S. stocks of late. This will (likely) be the final one on…

U.S. Stocks Do Something They Haven’t Done In 60 Years

If you are reading this, you are most likely aware of the milestone achieved by the Nasdaq Composite today. After more than 15 long years,…

Smart Money Options Indicator Now ‘Off The Charts’ Bearish

We have mentioned the put/call ratio of open interest on S&P 100 (OEX) options a handful of times over the past 6 months or so.…

U.S. Stocks Still Spinning Their Wheels

We have spent quite a bit of ink in this blog recently covering various aspects, and potential implications of the ongoing range in the U.S.…

South Korea Joins Asian Equity Party

On December 6, we pointed out a potential “bear flag” in the chart of South Korea’s main stock average, the KOSPI Index. As the name implies,…

Bond/Utility Divergence a Warning Sign…for the S&P 500?

Given their relatively high yields, utility stocks have long been thought of as proxies, or at least competition, for bonds. And while that relationship is…

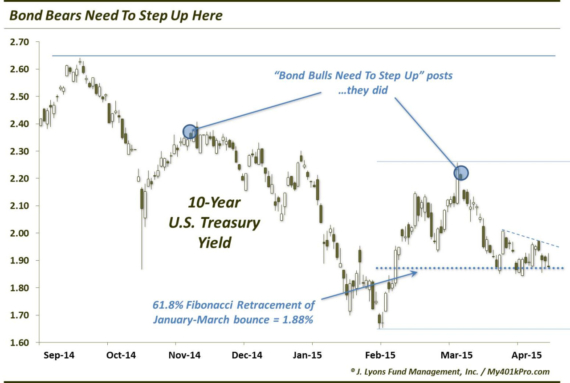

Bond Bears Need To Step Up Here On November 5 of last year and March 9 of this year, we posted charts of the U.S.…