European stocks bounce at precisely the right spot

As it pertains to the recent sell off in stocks, no region got hammered worse than Europe. The damage there was across the board as…

As it pertains to the recent sell off in stocks, no region got hammered worse than Europe. The damage there was across the board as…

We take a step away from equities today to focus on the Euro currency. The Chart Of The Day that we posted earlier on Twitter…

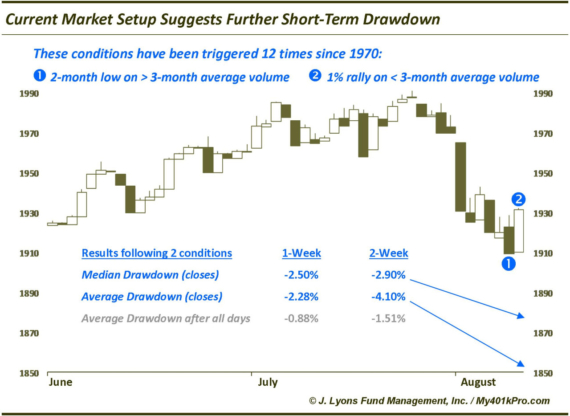

Current setup suggests further short-term stock market weakness (Edited to add last paragraph and table) With the S&P 500 futures ripping a slingshot 50-handle bounce…

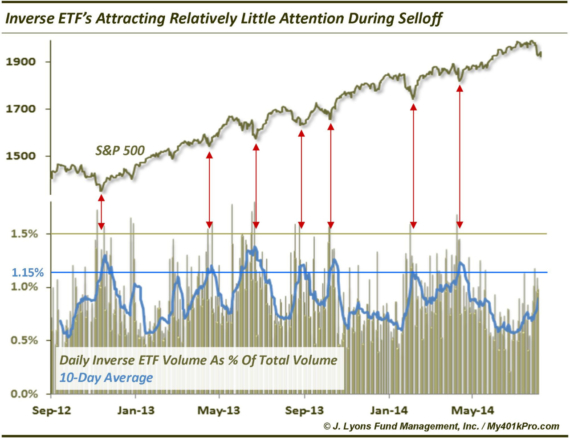

Subdued inverse ETF volume far from fear levels We’ve pointed out evidence of elevated fear (at least in the short-term) coming from the equity options…

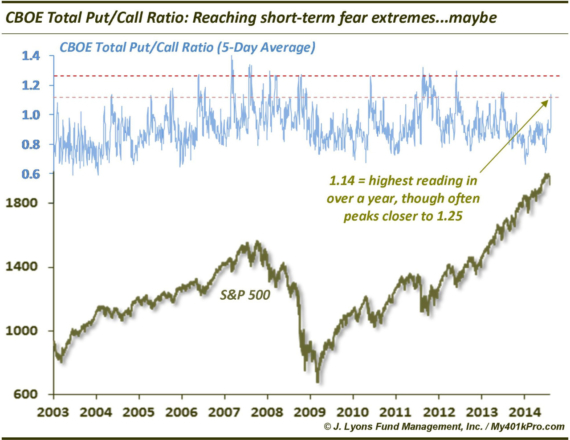

More signs of extreme fear in the options market…maybe On Monday, we noted Friday’s all-time low reading in the ISE Equity Call/Put Ratio as an…

Country Spotlight: It’s now or never for Russian stocks It goes without saying there have been significant developments in Russian stocks since our last update…

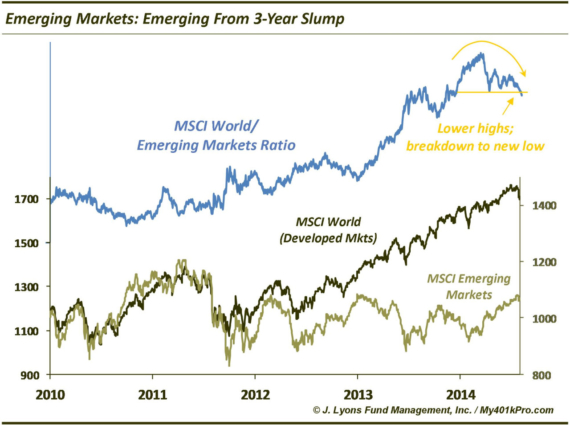

Emerging Markets emerging from 3-year slump We temporarily interrupt the new-found short-term equity market volatility and its accompanying hyper-sonic rise in investor fear to take…

My401kPro’s August update is in. Log in to check out the Commentary, current Equity Allocation and your Fund Rankings at My401kPro.com. Not a subscriber? Get…

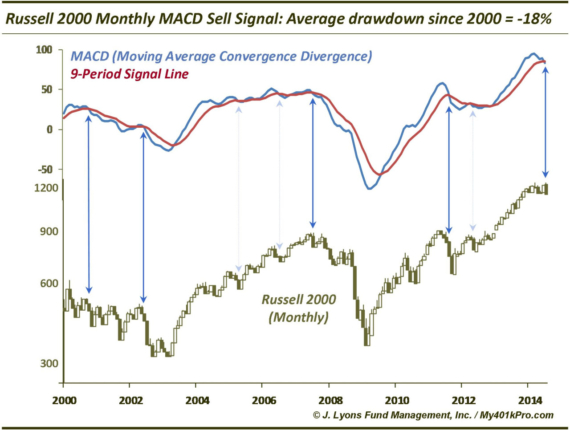

Long-Term Sell Signal Triggered In Small Caps Our investment process, for both managed assets and subscriber services, is entirely driven by market-derived data, as opposed…

To say that readings in the equity options market on Friday were extraordinary would be a gross understatement. They were downright historic. To wit, our…