Speculators have established their largest ever net long position in crude oil futures; are they about to get drilled? While all of the attention is…

Speculators have established their largest ever net long position in crude oil futures; are they about to get drilled? While all of the attention is…

Speculators in crude oil futures are back near their “obscene” record net-long position set just prior to the 2014 collapse in oil prices. When we…

Crude oil prices may be hitting the most significant level of resistance since launching their rally in February. In a year of interesting market moves,…

The Oil Volatility Index convincingly broke below its post-2014 Up trendline today; that could mean less volatility ahead for oil prices. Volatility indexes have become…

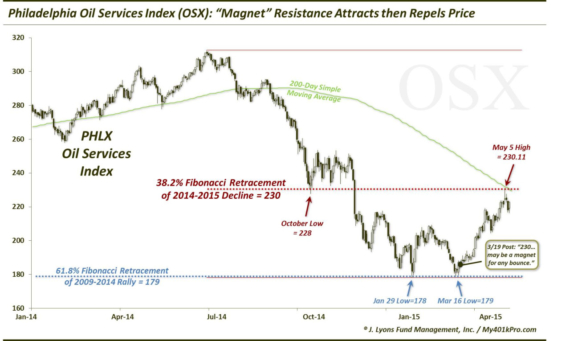

Oil Services Sector Reaches Resistance Magnet On March 19, as the oil complex was attempting to hammer out a low, we posted a chart on…

On March 13, we posted a piece on the divergence between the Euro and the Euro Volatility Index (EVZ). The EVZ (like most volatility indexes)…

I have mentioned before that it is not our style to try to catch “falling knives” in the financial markets. We just don’t like getting…

Copper, they say, is the only metal with a Ph.D. Given its many industrial uses, the movement in copper prices has, at times, foreshadowed the…

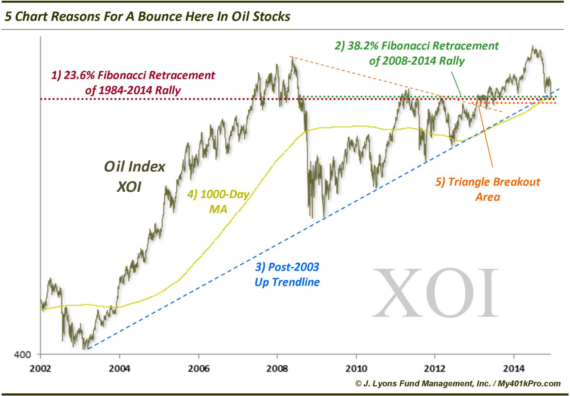

5 Chart Reasons For A Bounce In Oil Stocks Earlier today, we put up a post revealing that total assets in Rydex energy sector funds…

One of the casualties of the rout in oil prices and associated stocks, not surprisingly, has been the amount of assets invested in related energy…