Reluctantly, we wade into the economic arena with today’s Chart Of The Day. We have discussed the topic of corporate core capital expenditures (CapEx) on…

Tagged $^GSPC

This shift in a Smart Money indicator may be negative for stocks

The theory goes that trading done in the stock market early in the day is indicative of the eager and emotional “dumb money” reacting to…

“Everything Is Awesome” Brought To You By The Fed

Some days, the stock market soars at the expense of bonds. Other days, it is commodities like oil or gold that shine. And some days,…

“Everything Is Awesome” Brought To You By The Fed

Some days, the stock market soars at the expense of bonds. Other days, it is commodities like oil or gold that shine. And some days,…

401(k) Stock Allocation Highest Since 2007

More than 7 years after the cyclical top in 2007, 401(k) investors are finally getting more comfortable with stocks again. According to Aon Hewitt, the…

Should Investors Really Be Wary Of The Ides Of March?

The “Ides of March” corresponds to March 15th in the Roman calendar. The term became popularized in Shakespeare’s play “Julius Caesar” in which the emperor…

Despite Dow’s Big Up Day, More Volume In Declining Issues

In a February 27 post (Heavy Selling For Such A Small Loss), we noted that despite a minuscule decline in the S&P 500 the prior…

Aging Bull Market Turns 6-Years Old

This post is more of a birthday card for the U.S. equity bull market than anything else. And considering the duration of the bull, if…

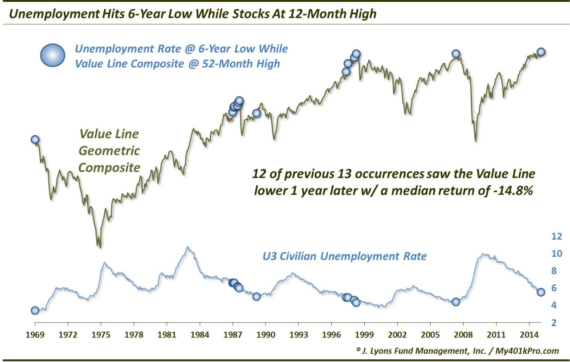

Unemployment Hits 6-Year Low; Bad News For Stocks? OK, before we get a barrage of hate mail, no, we do not think the drop in…

“Smart Money” Indicator Most Bearish In 16 Years

Most of the volume data (i.e., Put/Call ratios) that we look at from the equity options market are best utilized on a contrarian basis. That…