While the S&P 500 his on an impressive string of new highs, a number of them have come on questionable breadth. When it comes to…

While the S&P 500 his on an impressive string of new highs, a number of them have come on questionable breadth. When it comes to…

The S&P 500 has now tied a record with 9 consecutive days trading within the range set 10 days ago; what are the ramifications of…

An index of the largest stocks in the market just formed an apparent triple top – but is it a legitimate concern? One topic on…

Micro-cap stocks have suffered a key breakdown relative to mega-cap stocks, suggesting a “risk-off” shift on the part of investors. One of the themes in…

We have mentioned the put/call ratio of open interest on S&P 100 (OEX) options a handful of times over the past 6 months or so.…

Most of the volume data (i.e., Put/Call ratios) that we look at from the equity options market are best utilized on a contrarian basis. That…

A good portion of our research deals with the behavior of select groups of investors. The majority of the time, our objective is to identify…

As we wrap up 2014, we are looking back at the key moments, trends, stats and, of course, charts that defined the year in the…

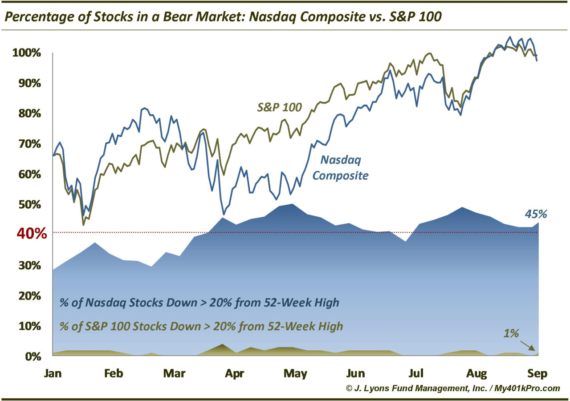

Percentage of Stocks in a Bear Market: Nasdaq vs. S&P 100 Yesterday, Bloomberg published a provocative article indicating that 47% of Nasdaq stocks were currently…

Following in line with yesterday’s chart on the # of 52-week highs, today’s ChOTD looks at the median distance from 52-week highs among S&P 100 and…