A key index of oil stocks has moved back above its (temporarily broken) 30-year up trendline…for now. “If the XOI can reclaim that broken trendline,…

Tagged $^XOI

The Line In The (Oil) Sand

The current test of a 30-year trendline could determine whether or not the bounce in oil stocks is sustainable. What do all the inquiring minds…

Will 30-Year Trendline Put Cap On Oil Stock Drop, Or Lead To Another Gusher?

The post-1985 UP trendline could provide support for the XOI Index – but a break could accelerate losses. With oil and oil stocks at the…

Energy Stocks Flowing Up Wall Of Worry?

Despite sharp bounce, energy funds have not yet attracted heavy inflows. Much of the market debate currently is centered around the question of whether the…

Oil Stocks Testing Breakdown Level Of Long-Term Uptrend

One of the biggest casualties of the recent stock market decline has been energy stocks. One may even argue that they are the culprit, or…

Oil Services Sector Again Testing Key Support (& Fate?)

Back on March 19, we noted that the key Oil Services Index (OSX) was testing an important line of support. Specifically, it was the 61.8%…

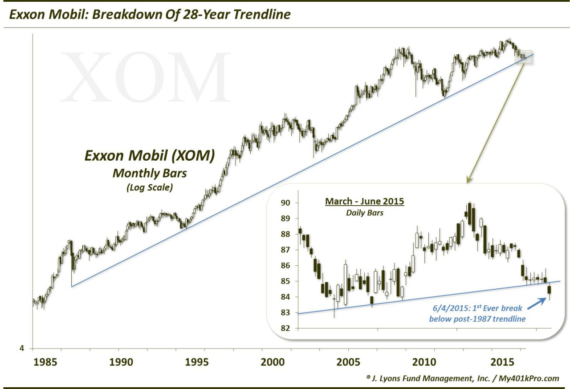

Update: World’s 2nd Biggest Stock Breaking 28-Year Trendline On March 24, we posted a rare piece on an individual stock. As we do not invest…

A Glimmer of Hope for Oil Bulls

On March 13, we posted a piece on the divergence between the Euro and the Euro Volatility Index (EVZ). The EVZ (like most volatility indexes)…

World’s 2nd Largest Stock Testing Historic Trendline

We don’t often discuss individual stocks, either in our practice or in these pages. So when we dedicate our Chart Of The Day to a…

Gas Prices Far Outpacing Crude: Blowoff Top or Long-Term Bottom?

If you’re like us, maybe you wonder why gas prices always seem to go up a lot faster than they come down. That’s our anecdotal…