This is part 2 of our series (or mini-series…TBD) on divergences. As we stated yesterday, divergences (in which one index achieves a new high whereas…

From Uncategorized

Dow Divergences Part 1: Transports

Divergences are one of the most oft-cited arguments in calling tops. They are also perhaps the least accurate. That’s because divergences (whereby one index reaches…

Dr. Copper: Rebound Diagnosis Was Correct…What’s Next? Resolution at 2.95 may shape the inflation/deflation debate On January 14, we wrote a post titled “Dr. Copper Positioned…

One Gauge Of Investor Sentiment Just Hit A 6-Year High

There’s no question that the general level of stock investor sentiment is at historically high levels at this time. However, I think it’s probably safe…

With Banks At New Highs, Are Stocks Out Of The Woods?

With the major indexes again pushing up near new highs, it is a good reminder that despite all of the ancillary concerns about the market…

Will Spike In Rates Hurt Stocks?

The current consternation among global equity markets is centered around the recent considerable rise in bond yields globally. There seem to be equal numbers of…

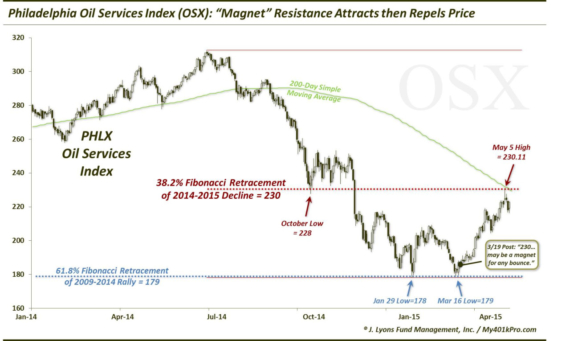

Oil Services Sector Reaches Resistance Magnet On March 19, as the oil complex was attempting to hammer out a low, we posted a chart on…

Stock Indicator Suggests Big Move (Lower?) Coming

We don’t talk too often (because we don’t use them) about traditional technical analysis indicators. We have nothing against them; it’s just that we have…

A Curious Spike In Inverse ETF Volume

One of our favorite new short-term sentiment gauges in recent years has been relative inverse ETF volume. This indicator measures the amount of volume traded…

Will Equities Follow Drop In Corporate Bonds?

One of the Wall Street platitudes often repeated is that the bond space is the “smart” market, particularly when in conflict with equities. That is, when…