UPDATE: Time To Take (some) Profits In China ADR’s On July 29, we posted a chart showing the breakout in the Bank of New York…

UPDATE: Time To Take (some) Profits In China ADR’s On July 29, we posted a chart showing the breakout in the Bank of New York…

With much of the investment world intently scrutinizing each tick in the S&P 500 and parsing each syllable uttered by an American and European central…

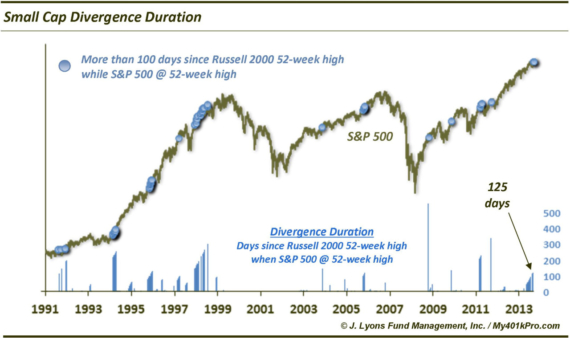

Is the duration of the small cap divergence a concern? We have commented on many occasions about the importance of broad participation of stocks and…

OK, so Paul Revere wasn’t talking about British stocks; but he might have been had he seen the potential development in the London FTSE 100.…

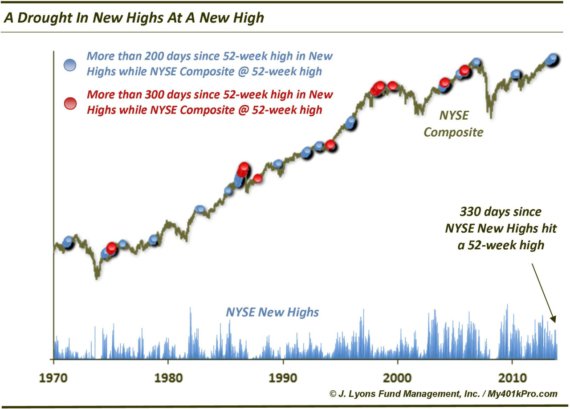

52-Week Highs Struggling To Reach 52-Week Highs The grand daddy of all breadth indicators, the NYSE advance-decline line, recently made an all-time high. This is…

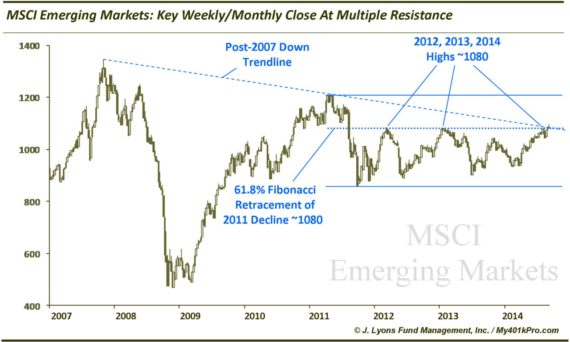

Emerging Markets face key weekly/monthly close at multiple resistance Over the past several months, we have grown increasingly constructive on a possible longer-term bottom developing…

Yesterday we pointed out that the 3-day range in the Nasdaq 100 was currently the smallest in the index’s history. Today we look at another…

The current low-volatility environment has been so epic that posts on low volatility have just become mundane. That said, every once in a while we…

It’s no secret that stock exchange volume has been declining for some time. It’s also no secret that volume in August, particularly towards the end…

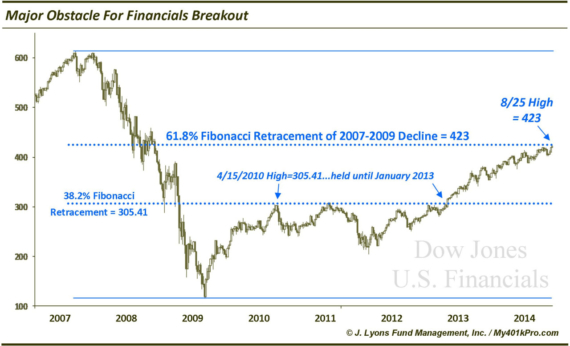

One Major Obstacle To This Breakout In Financials There has been quite a bit of chatter recently regarding the relative weakness on the part of…