“90% Down Days” often mark a selling climax…but occasionally ignite a much larger decline. “Is this to end or just begin?” – All My Love…

Tagged Breadth

Bad Breadth Milestone A Warning For Stocks?

We’ve been discussing the weakening market breadth recently, especially as it pertains to New Highs vs. New Lows. Again, our contention is that the more…

Bull Market Dealt A Significant Blow?

In January, we wrote a post titled “Are Bears Missing The Forest For The Trees?”. The gist of it was that while there were certainly concerning…

Another “Less Than Meets The Eye” Rally In The Nasdaq?

For the second Friday in a row, the Nasdaq put in a rally that, under the surface, was not as impressive as its headline gain…

Less Than Meets The Eye In Nasdaq Rally?

It’s a day removed from Friday’s all-time high in the Nasdaq but we posted a couple Charts Of The Day today that had folks wondering…

An Odd Breadth Situation

We’ve written about divergences in breadth (i.e., advancing issues vs. declining issues) on several occasions in the past. These such posts have included breadth divergences…

Despite Dow’s Big Up Day, More Volume In Declining Issues

In a February 27 post (Heavy Selling For Such A Small Loss), we noted that despite a minuscule decline in the S&P 500 the prior…

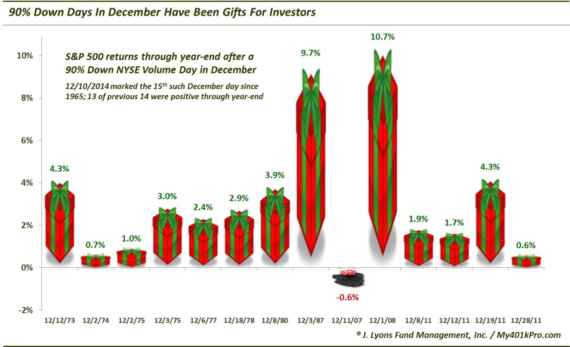

90% Down Days In December Have Been Gifts For Investors We have explored the phenomenon of “90% Down Volume Days” on a number of occasions…

Nasdaq Divergence Suggests More Weakness But Bottom Near

Yes, yet another divergence post. We’re trying to stay away from them but some developments are just too noteworthy to ignore. Yesterday, we looked at…

ChOTD-5/8/14 Historic Divergence Between NYSE, Nasdaq Advance/Decline Lines

Several of our recent ChOTD’s have revealed the significant deterioration in some areas of the market (i.e., Nasdaq, small-caps, biotech), either on an absolute basis…