The theory goes that trading done in the stock market early in the day is indicative of the eager and emotional “dumb money” reacting to…

Tagged $DIA

An Odd Breadth Situation

We’ve written about divergences in breadth (i.e., advancing issues vs. declining issues) on several occasions in the past. These such posts have included breadth divergences…

401(k) Stock Allocation Highest Since 2007

More than 7 years after the cyclical top in 2007, 401(k) investors are finally getting more comfortable with stocks again. According to Aon Hewitt, the…

Should Investors Really Be Wary Of The Ides Of March?

The “Ides of March” corresponds to March 15th in the Roman calendar. The term became popularized in Shakespeare’s play “Julius Caesar” in which the emperor…

Despite Dow’s Big Up Day, More Volume In Declining Issues

In a February 27 post (Heavy Selling For Such A Small Loss), we noted that despite a minuscule decline in the S&P 500 the prior…

Aging Bull Market Turns 6-Years Old

This post is more of a birthday card for the U.S. equity bull market than anything else. And considering the duration of the bull, if…

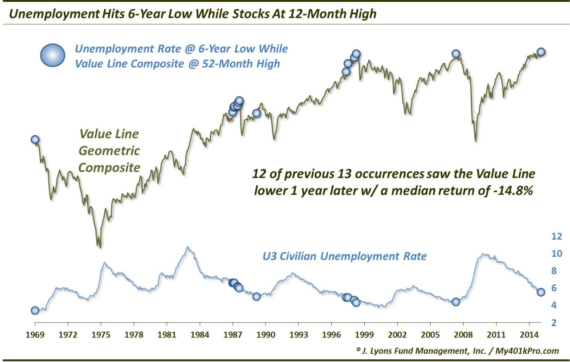

Unemployment Hits 6-Year Low; Bad News For Stocks? OK, before we get a barrage of hate mail, no, we do not think the drop in…

Should You Break Up With Stocks?

In a February 9 post titled Seasonal Trend Says Date This Market, Don’t Commit, we looked at historical market tendencies when a weak January was…

Heavy Selling For Such A Small Loss

On the surface, yesterday was a pretty nondescript day in the U.S. equity market with the major averages showing slight gains or losses. About the…

Seasonal Trend Says Date This Market, Don’t Commit

The stock market chop continued last week with major indices rallying from the bottom of the 2-month range to back near the top. With Valentine’s…