This brief post will serve as the coup de grace for our “Junkie Market” series. By that, we are referring to days on which there are…

Tagged New Highs-New Lows

The Summation Of All Fears

This negative breadth signal has an ominous long-term track record. Yes, this is another post about the market’s deteriorating breadth situation. We can’t pick the…

It’s Bounce Or Else For This Key Stock Market Gauge

We’ve used much of the space here in the past several weeks pointing out the deteriorating breadth conditions in the U.S. equity market. The trend…

The Junkie Market-Nasdaq Edition (Too Many Highs & Lows)

A couple weeks ago, we posted a piece titled “The Junkie Market”. The focus of the post was on the number of New Highs and…

The Thinnest New High In Stock Market History

When we posted yesterday’s piece on the stock market’s weak internals (If Beauty’s On The Inside, This Market Wins The Ugly Contest), we weren’t sure…

The Junkie Market: Too Many Highs And Lows?

Most market participants have probably heard of the oft-ridiculed indicator known as the “Hindenburg Omen” (HO). If you are not familiar with it, there are several…

Bad Breadth Milestone A Warning For Stocks?

We’ve been discussing the weakening market breadth recently, especially as it pertains to New Highs vs. New Lows. Again, our contention is that the more…

Is Relative Spike In Nasdaq Internals A Major Buy Signal?

We spend quite a bit of time researching (i.e., messing around with) various data sets looking for an edge in the markets. In this pursuit,…

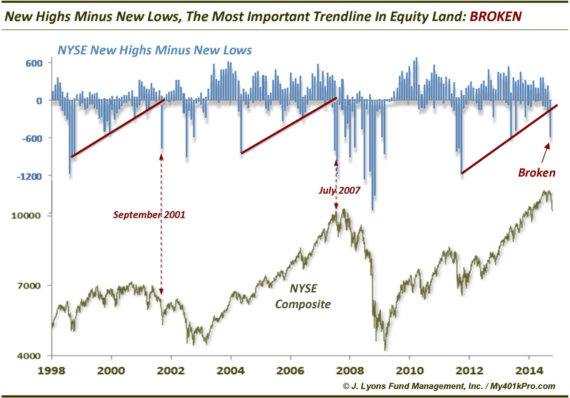

UPDATE: The Most Significant Trendline In Equity Land = BROKEN On September 25, we presented what we termed, The Most Important Trendline In Equity Land, namely…

The Most Important Trendline In Equity Land: New Highs-New Lows The problem with trendlines is that they are usually subjective. Rarely are they cut-and-dry. And…