Equity options trading was extremely skewed toward puts yesterday, very unusual for a market that rallied strongly on the day, and over the past few…

Tagged Options

Options Hedging Hitting Extreme Levels

We have been seeing signs in the past few days of elevated levels of fear on the part of traders and investors. Yesterday’s post on…

Smart Money Options Indicator Now ‘Off The Charts’ Bearish

We have mentioned the put/call ratio of open interest on S&P 100 (OEX) options a handful of times over the past 6 months or so.…

“Smart Money” Indicator Most Bearish In 16 Years

Most of the volume data (i.e., Put/Call ratios) that we look at from the equity options market are best utilized on a contrarian basis. That…

Options Traders Growing Their Hedges

Last Thursday, we mentioned that traders in equity options on the International Securities Exchange exhibited a rare (though recently, less-so) display of cautious behavior on back…

Equity Options Traders Head For The Hills Again

Due to its unique construction, the International Securities Exchange Equity Call/Put Ratio (ISEE) has become a favorite indicator of ours for highlighting short-term inflection points in…

Smart Money Options Traders Displaying Extreme Caution

A good portion of our research deals with the behavior of select groups of investors. The majority of the time, our objective is to identify…

Stock Option Bulls Go Streaking

One method of analyzing stock market sentiment is by measuring activity in the options market. The benefit of this type of analysis is that, contrary…

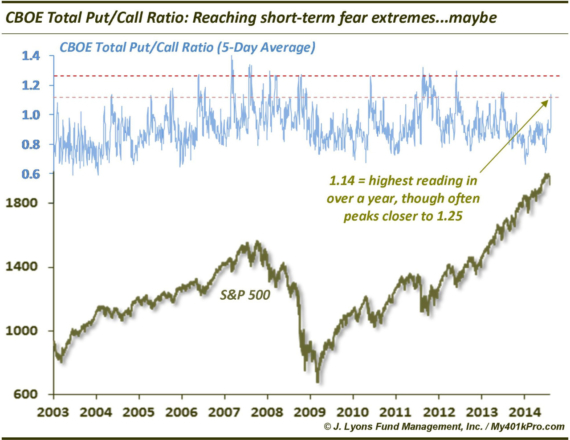

More signs of extreme fear in the options market…maybe On Monday, we noted Friday’s all-time low reading in the ISE Equity Call/Put Ratio as an…

ChOTD-7/11/14 High ISE Equity Call/Put Readings On Down Market Days Have Preceded Drawdowns

Today’s ChOTD looks at the International Securities Exchange (ISE) Equity Call/Put Ratio. For those unfamiliar, ISE presents options ratios a bit differently than most exchanges.…