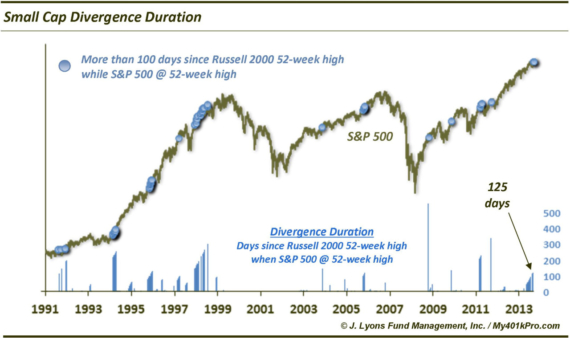

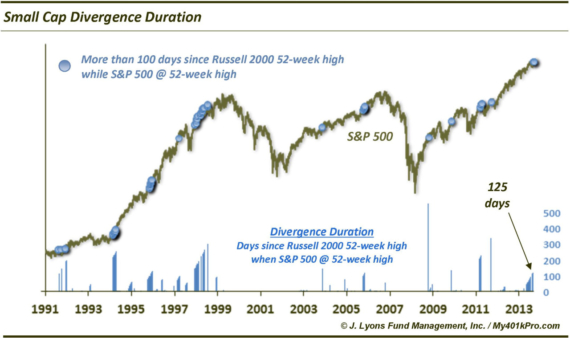

Is the duration of the small cap divergence a concern? We have commented on many occasions about the importance of broad participation of stocks and…

Is the duration of the small cap divergence a concern? We have commented on many occasions about the importance of broad participation of stocks and…

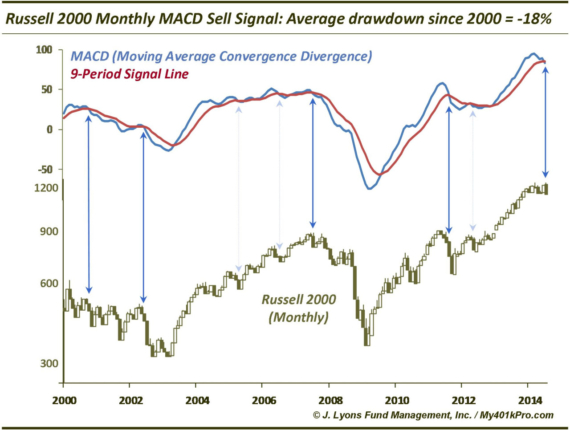

Long-Term Sell Signal Triggered In Small Caps Our investment process, for both managed assets and subscriber services, is entirely driven by market-derived data, as opposed…

Following in line with yesterday’s chart on the # of 52-week highs, today’s ChOTD looks at the median distance from 52-week highs among S&P 100 and…

Today’s ChOTD comes out of the bottomless “divergence barrel”. This one looks at the % of 52-week highs among S&P 100 constituents vs. Russell 2000…

This week we presented a series of charts outlining how recent index highs pass the so-called market top “look test”. By that we mean that…

Today’s ChOTD is the first in a series of charts outlining how recent index highs pass the so-called market top “look test”. By that we…

Much attention has been given, including our post here, to the significant weakness in the Small-Cap segment of the market, in particular relative to the rest…

It’s no secret that the Russell 2000 Small-Cap Index has been pummeled as of late. At the same time, the S&P 500 Large Cap Index…

We’ve been highlighting the major intermediate-term cluster of Fibonacci Retracement support on the Russell 2000 in the low 1100’s. As we stated in Monday’s ChOTD…

The Russell 2000 is nearing the first major intermediate-term cluster of Fibonacci Retracement support in the low 1100’s. The Fibonacci “trifecta” (23.6, 38.2 and 61.8)…