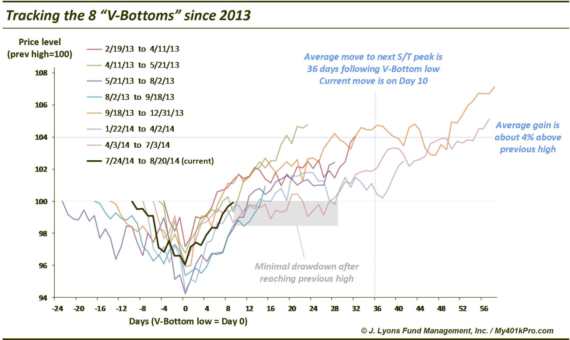

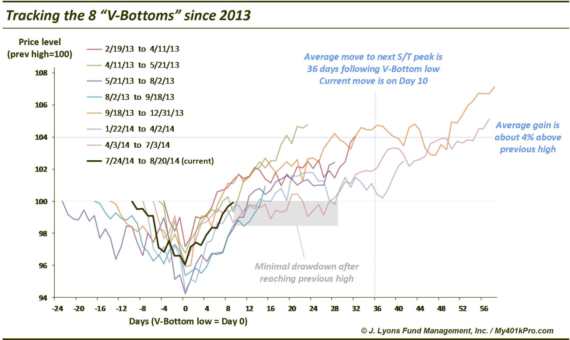

V-Bottoms Part 2: The Aftermath-What To Expect On Tuesday, we discussed the stock market’s new found propensity to form V-Bottoms over the past few years.…

V-Bottoms Part 2: The Aftermath-What To Expect On Tuesday, we discussed the stock market’s new found propensity to form V-Bottoms over the past few years.…

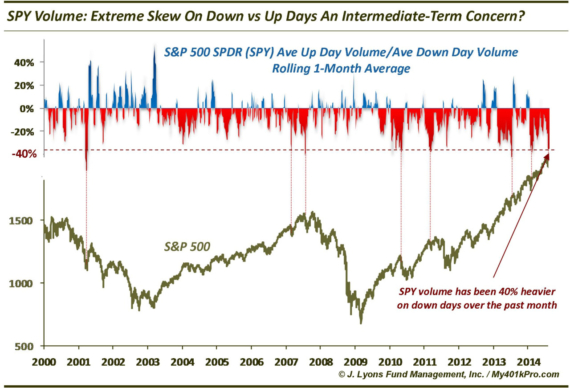

SPY Volume Extremely Skewed On Down Days We don’t typically pay a whole lot of attention to volume unless we see some anomalous behavior going…

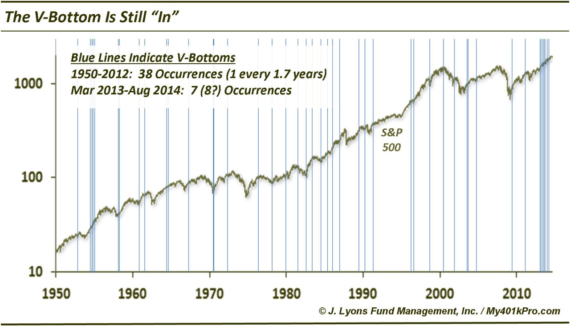

The V-Bottom Is Still In Fashion Back in February, we posted a chart on a new fad that was all the rage on Wall Street:…

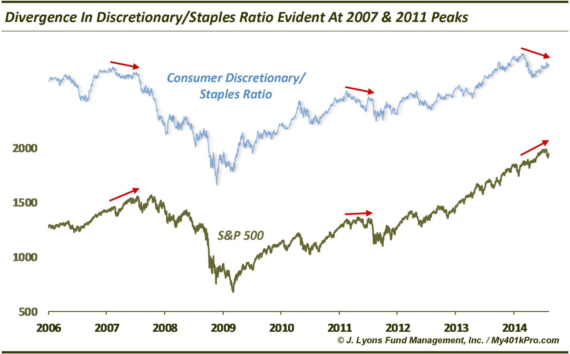

Divergence in discretionary vs. staples stocks a red flag After a brief pause on Friday for Mr. Putin’s VIX day-trade, another V-bottom continues apace in…

Sounds crazy, I know – that a stock breaking out might be sending a bearish signal for the stock market. It probably sounds particularly heretical…

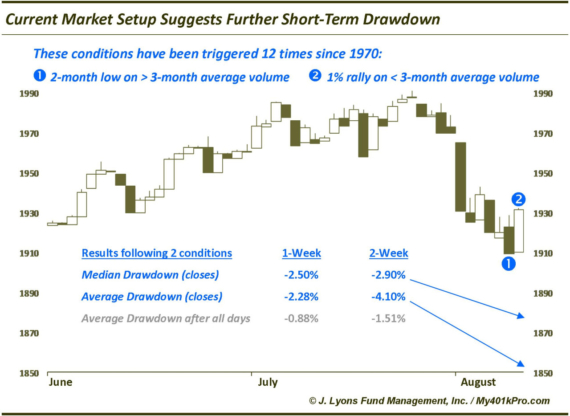

Current setup suggests further short-term stock market weakness (Edited to add last paragraph and table) With the S&P 500 futures ripping a slingshot 50-handle bounce…

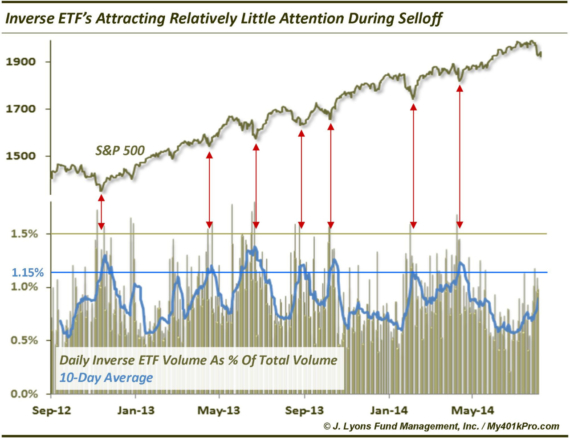

Subdued inverse ETF volume far from fear levels We’ve pointed out evidence of elevated fear (at least in the short-term) coming from the equity options…

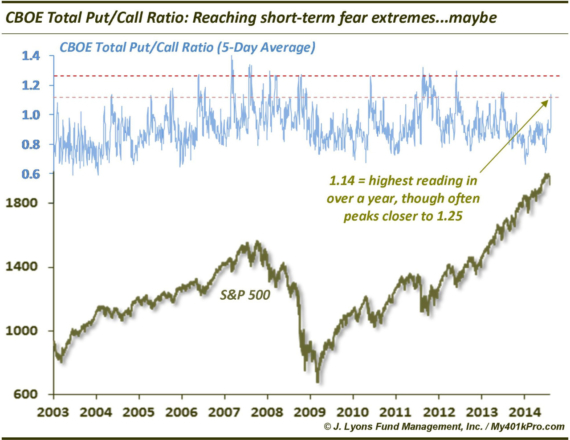

More signs of extreme fear in the options market…maybe On Monday, we noted Friday’s all-time low reading in the ISE Equity Call/Put Ratio as an…

To say that readings in the equity options market on Friday were extraordinary would be a gross understatement. They were downright historic. To wit, our…

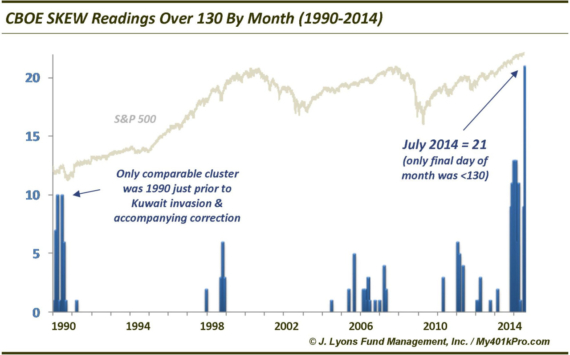

CBOE SKEW: Tail Risk Indicator Attains Dubious Record In July We’ve talked about the CBOE SKEW Index plenty over the past few months, given its…