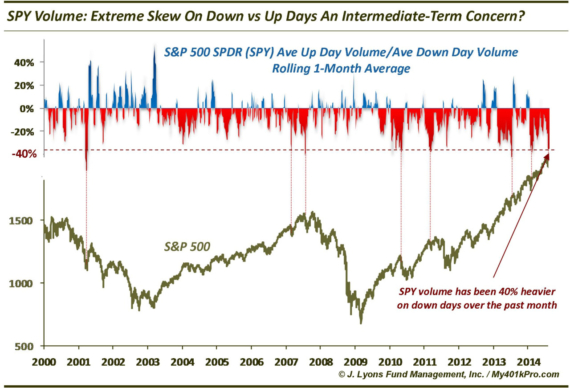

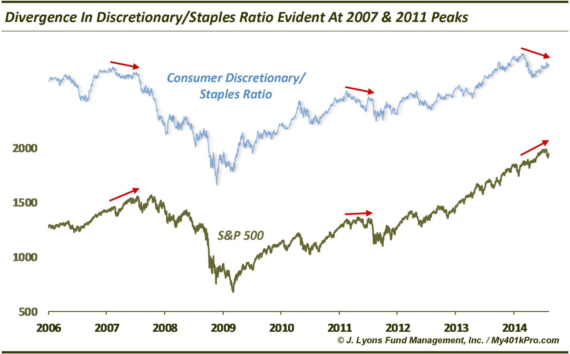

SPY Volume Extremely Skewed On Down Days We don’t typically pay a whole lot of attention to volume unless we see some anomalous behavior going…

SPY Volume Extremely Skewed On Down Days We don’t typically pay a whole lot of attention to volume unless we see some anomalous behavior going…

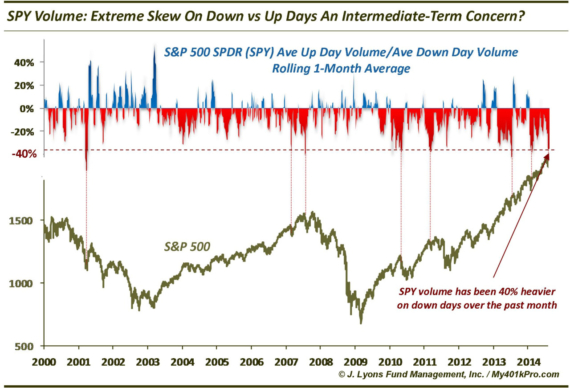

The V-Bottom Is Still In Fashion Back in February, we posted a chart on a new fad that was all the rage on Wall Street:…

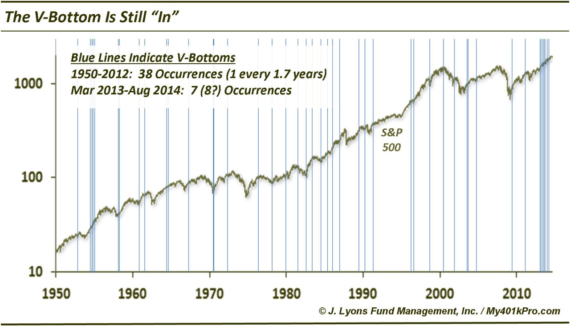

Divergence in discretionary vs. staples stocks a red flag After a brief pause on Friday for Mr. Putin’s VIX day-trade, another V-bottom continues apace in…

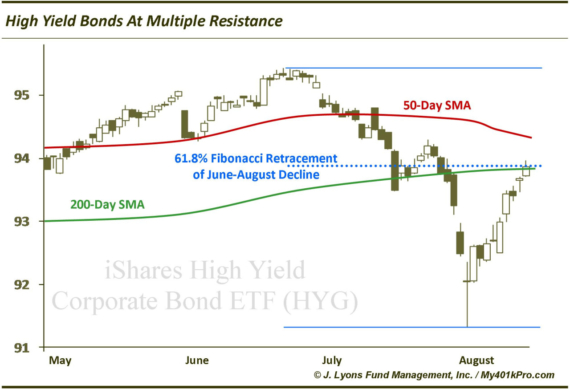

High yield bonds: the bear battle begins Perhaps no other market symbolizes this unprecedented central bank induced yield-reach era more than the high yield bond…

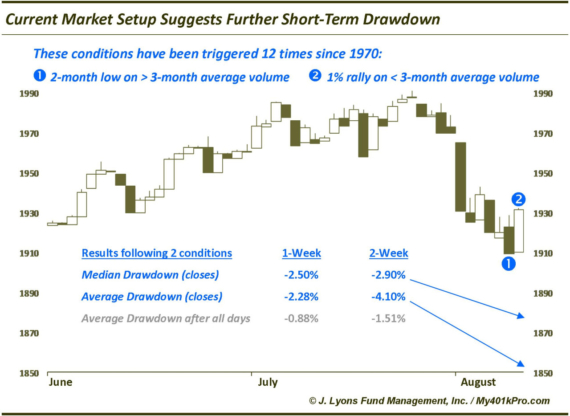

Current setup suggests further short-term stock market weakness (Edited to add last paragraph and table) With the S&P 500 futures ripping a slingshot 50-handle bounce…

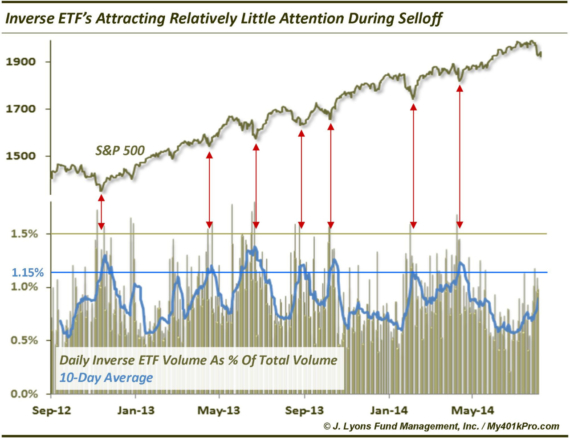

Subdued inverse ETF volume far from fear levels We’ve pointed out evidence of elevated fear (at least in the short-term) coming from the equity options…

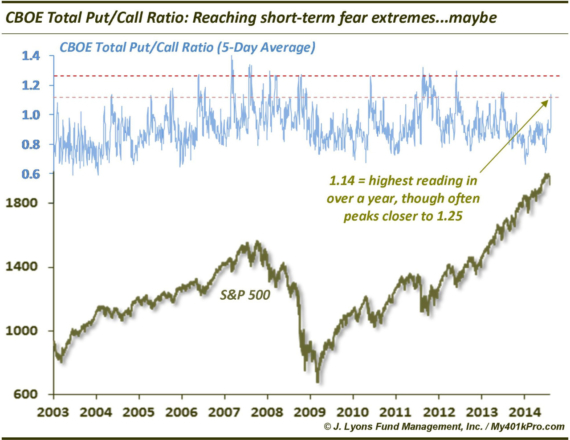

More signs of extreme fear in the options market…maybe On Monday, we noted Friday’s all-time low reading in the ISE Equity Call/Put Ratio as an…

Country Spotlight: It’s now or never for Russian stocks It goes without saying there have been significant developments in Russian stocks since our last update…

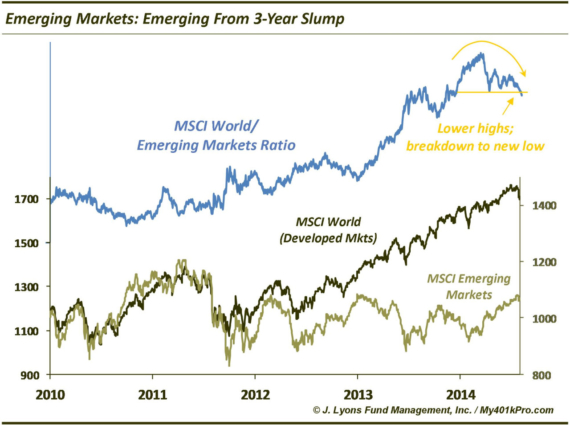

Emerging Markets emerging from 3-year slump We temporarily interrupt the new-found short-term equity market volatility and its accompanying hyper-sonic rise in investor fear to take…

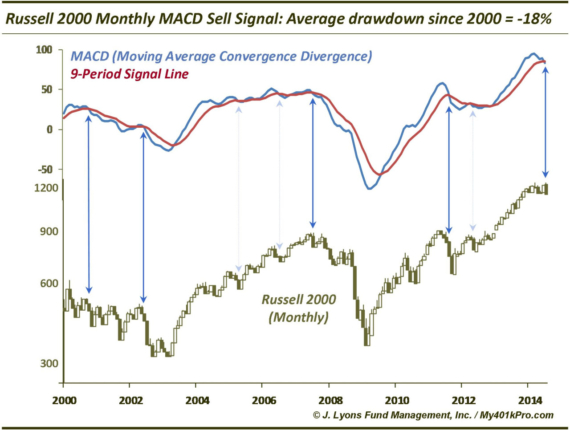

Long-Term Sell Signal Triggered In Small Caps Our investment process, for both managed assets and subscriber services, is entirely driven by market-derived data, as opposed…