We have repeated ad nauseam the litany of concerns we have regarding the longer-term fate of the U.S. stock market. These concerns include metrics pertaining…

From Uncategorized

Despite Historic Compression, Stocks Remain Range-Bound

On April 24, we posted what we thought (and hoped) would be our final post concerning the stock market’s lengthy trading range. In the post…

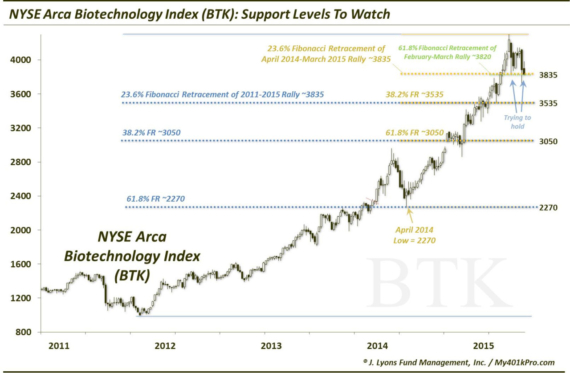

Biotech Sector: Support Levels To Watch No sector has exemplified these past few years of the cyclical bull market as much as biotechnology stocks. Likewise,…

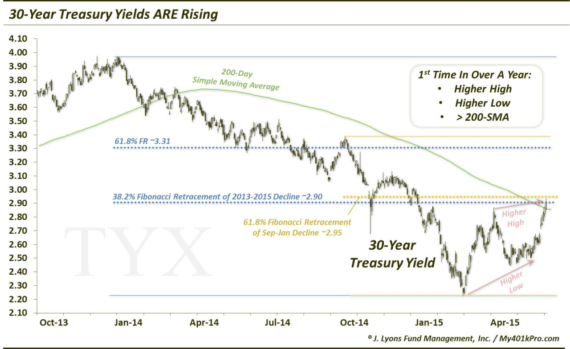

Rates ARE In Fact Rising For the better part of the last few years (decades?), if there was one thing that market strategists were sure…

52-Week Highs Are M.I.A.

** Edited to add the chart at the end. The subject of today’s Chart Of The Day seems like it may be more a matter…

Another “Less Than Meets The Eye” Rally In The Nasdaq?

For the second Friday in a row, the Nasdaq put in a rally that, under the surface, was not as impressive as its headline gain…

Could Stocks AND Bonds Be Topping?

There is always a small but vocal contingent of market pundits calling for a stock market top. In the past few years, there has been…

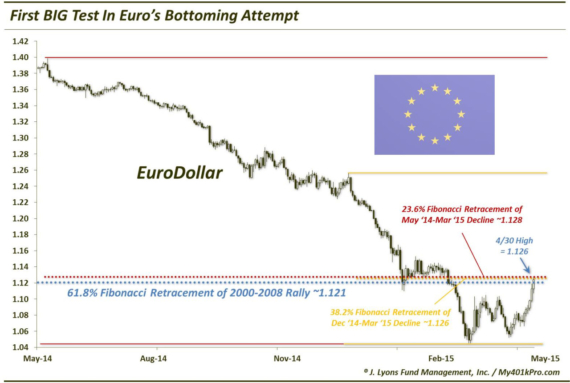

UPDATE: Euro Facing First BIG Test In Its Bottoming Attempt On March 4 we posted a piece titled “Setup In Place For Possible Euro Bottom”. In that post,…

May Has Become The (short-term) “Toppiest” Month

Yesterday, we looked at the “Sell In May & Go Away” phenomenon, with a couple new twists. With many seasonality-type indicators or trends, it is common…

A Few Twists To The “Sell In May” Phenomenon

If you follow the stock market closely, you are no doubt aware of the “Sell in May and Go Away” adage. If not, you will…