We have spent quite a bit of ink in this blog recently covering various aspects, and potential implications of the ongoing range in the U.S.…

Tagged $^ixic

Similar S&P 500 Ranges Have Always Resulted In New Highs, But…

Yesterday, we looked at the unusual uptick in stock market volatility despite its recent range-bound behavior. Today, we look at the S&P 500′s recent range…

Despite Range Bound Market, Stock Volatility Expanding

In a post last week, we discussed the recent uptick in stock market volatility as measured by the number of 1% up and down days…

Stocks Near Highs But Retail Trading Subdued

We have covered many of the popular and not-so-popular stock market sentiment indicators over the past several months. With the exception of some very short-term…

Rise in Stock Volatility Near the Highs May Be a Red Flag

After opening significantly lower today following the weak jobs report on Friday, the stock market turned sharply higher, trading up close to 1% before fading…

In The Presidential Cycle, April May Hold The Key For Year 3

On Tuesday, we discussed the likelihood of the stock market making a new high during the month of April. In this post, we show why…

Gap Widening Between Stocks & CapEx

Reluctantly, we wade into the economic arena with today’s Chart Of The Day. We have discussed the topic of corporate core capital expenditures (CapEx) on…

This shift in a Smart Money indicator may be negative for stocks

The theory goes that trading done in the stock market early in the day is indicative of the eager and emotional “dumb money” reacting to…

An Odd Breadth Situation

We’ve written about divergences in breadth (i.e., advancing issues vs. declining issues) on several occasions in the past. These such posts have included breadth divergences…

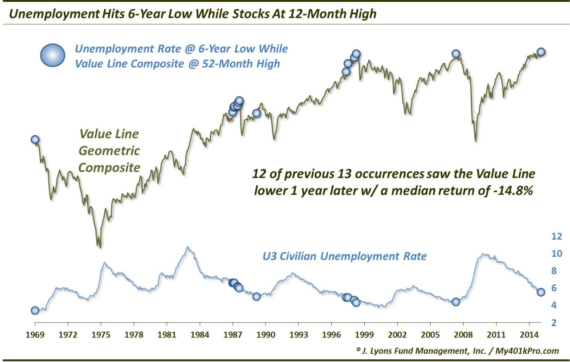

Unemployment Hits 6-Year Low; Bad News For Stocks? OK, before we get a barrage of hate mail, no, we do not think the drop in…